BUDGET BEDLAM

|

I am very disorganised in my financial affairs. I’m frequently overdrawn and take care of my bills only when I have to.

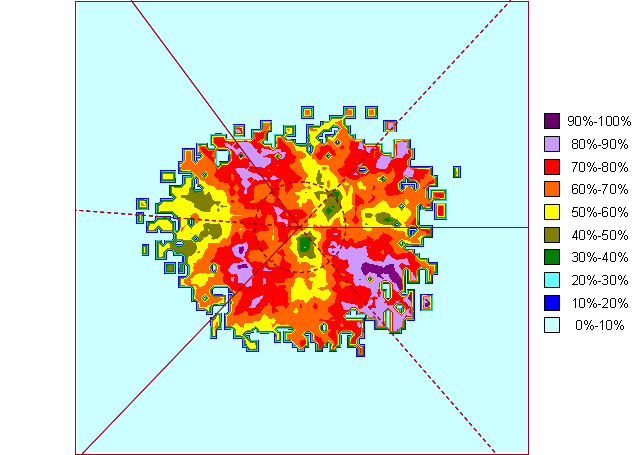

Budget Bedlam is spread across most age groups, only falling below average in the very young and very old. It peaks in the 22-34 age group.

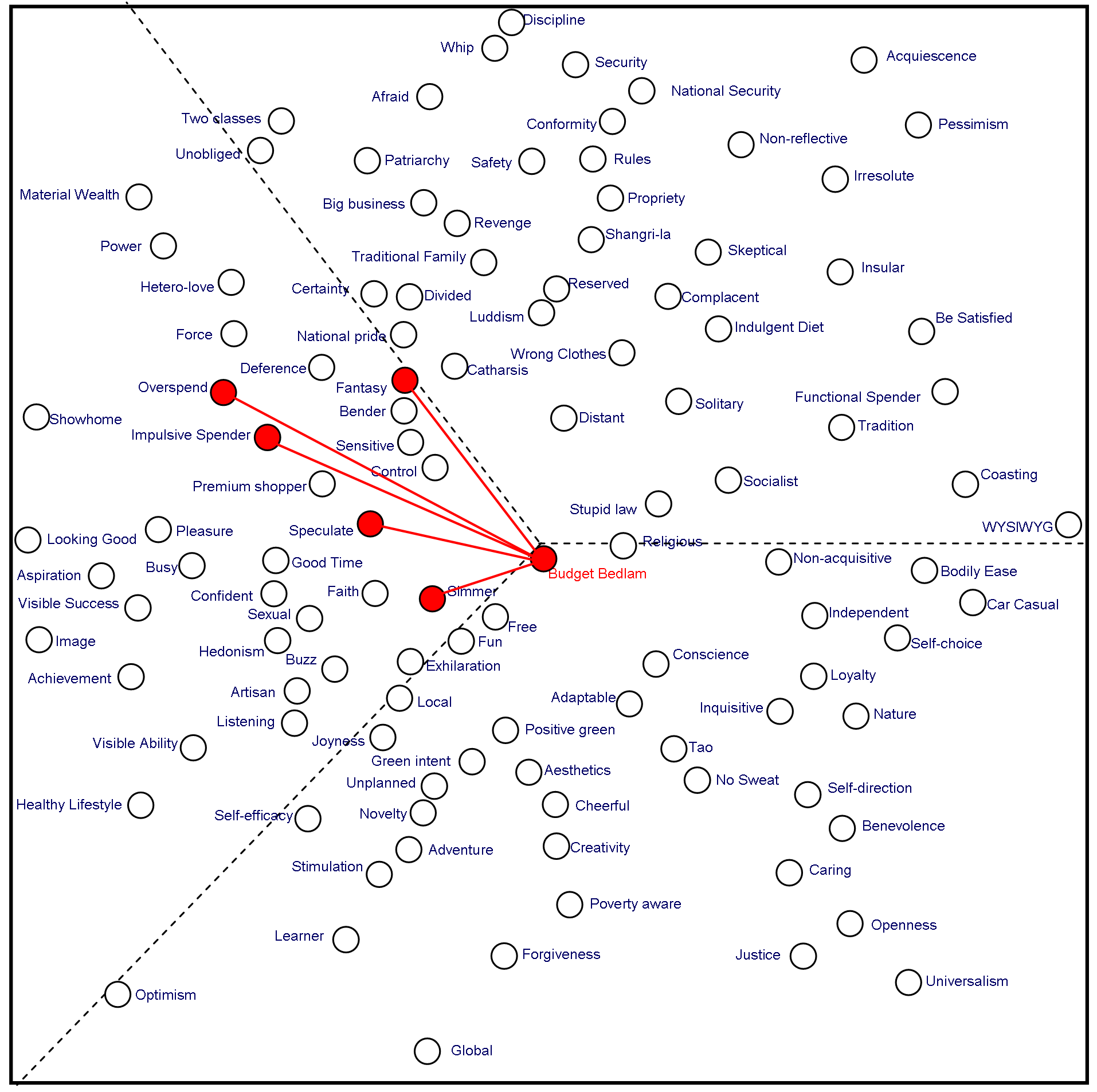

Looking at this map it is clear that this is not strictly a values-driven Attribute – all groups have their own version of Budget Bedlam. This makes it intriguing when trying to tease out ways to make people, especially Budget Bedlam people, to become more ‘responsible’ when handling their personal finances.

There are clear factors in this orientation which will mitigate against a ‘quick fix’ or a rational solution typified by the ‘just say no’ admonitions beloved of financial experts.

The first is the study of correlations allied to this orientation, and finding that the strongest connection is with the Impulsive Spender Attribute. This is so clear that it is almost laughable. Budget Bedlam people are in bedlam because they are impulsive in their spending. It is spending to get the things they fancy in the heat of the moment that has got them into financial trouble. They prefer immediate gratification to the discipline of saving and looking forward to a planned purchase. They are the children who ‘ate the Haribo’.

This impulsiveness is compounded by yet more over-indexing – this time on the Overspend Attribute. These people are not only impulsive but are spending more than they can afford. This is a potent combination of non-rational or emotionally-driven financial behaviours.

A lot of these behaviours will be driven by a sense that life is to be lived, so why wait. These people are in the early stages of being adults – actually and subconsciously – and the lure of being ‘a grown-up’ and having what they want when they want it is a powerful emotional driver. ‘Live now pay later’ is a resonant mantra for people with this values set.

Taking a risk is part of this values set as well. Living a bit on the edge has its attractions. They are likely to feel they could play the stock market better than a stockbroker. Their need to take a risk includes behaviours up to and including civil disorder.

This potential high energy ‘edge’ is mitigated for the majority of these espousers by their propensity to have a well-developed fantasy life. They are more likely than the average person to agree that they sometimes find it hard to tell where fantasy ends and reality begins. Life is exciting and confusing - and their disorganised finances are just one aspect of lives that are exciting, fun and confusing all at the same time.

They are not despairing in their lack of order in different parts of their life. They are turning their dreams into reality – wishes into objects and situations they could only dream about in their past. They know that a day of reckoning will come – but will enjoy today as long as they can.

‘Just say no’ doesn’t have the same power as ‘buy now, pay later’ to Budget Bedlam espousers.

Using Budget BedlamDemographic Skews: 1) Over indexed: 22-34 2) Under indexed: Under 18 and over 55 Budget Bedlam espousers also espouse other attributes. The top five most highly correlated attributes of Budget Bedlam espousers are, in order of the strength of relationship: 1) Impulsive Spender In total those who espouse Budget Bedlam also over-index significantly on 29 other Attributes. |

|

If "Budget Bedlam" (or the associated attributes) are important to you and you would like to delve more deeply, contact us at mail@cultdyn.co.uk